Buying a home is one of the biggest investments you can make in a lifetime, but finding a home in your price range can be daunting. That’s why many buyers look to fixer-uppers as practical solutions. Discover the top 10 things to know before buying a fixer-upper today.

1. Start With a Home Inspection

Table of Contents

Before buying any historic homes for sale in Charleston, SC, begin with an inspection. Every real estate transaction requires an inspection before a property transfer goes through. You can get ahead of the process by paying for an inspection before it’s required.

Be present at the inspection as the professional works around the property. See any issues firsthand while allowing them to complete the work uninterrupted. You’re welcome to ask any questions afterward. This inspection and the detailed report can tell you if the fixer-upper is worth another look.

2. Take Account of Your Renovation Budget

Your savings should be enough for renovation costs and basic monthly payments. Because a fixer-upper is often cheaper than surrounding properties, your renovation budget may have some wiggle room. Remember that owning a home will have several different monthly costs, such as insurance, HOA dues, property taxes, principal and interest. Total expenses for fixer-uppers can be difficult to estimate. Still, you can do your best to keep within the budget.

3. Avoid Quick Decisions

Investing in a fixer-upper requires a practical perspective while leaving emotion out of the equation. The real estate market is a competitive place. You might be tempted to quickly buy that fixer-upper before someone else snatches it. Keep up with the research and inspection, but don’t hasten the purchase of a house for sale in Mount Pleasant, SC. If this property doesn’t end up in your possession, there will be other choices in the future.

4. Consider What You Can Do

You’ll save considerable money on the fixer-upper if there are renovations you can complete. DIY skills can work for simple tasks, such as painting a room or replacing interior doorknobs.

It’s also critical to know your limitations. Take account of the renovations that cannot be DIY options, including structural repairs, electric issues, or items requiring a permit.

5. Estimate Contractor Costs

Use the inspection report to estimate contractor costs. Research both materials and labor associated with each repair. Contact professionals in the area for estimates if possible. Some companies offer free estimates but ask about this possibility up front. With a solid estimate on a few repairs, you can gauge whether a property is worth purchasing.

Avoid paying several contractors for estimates. You don’t want to invest extra money into a property that may not be bought in the first place.

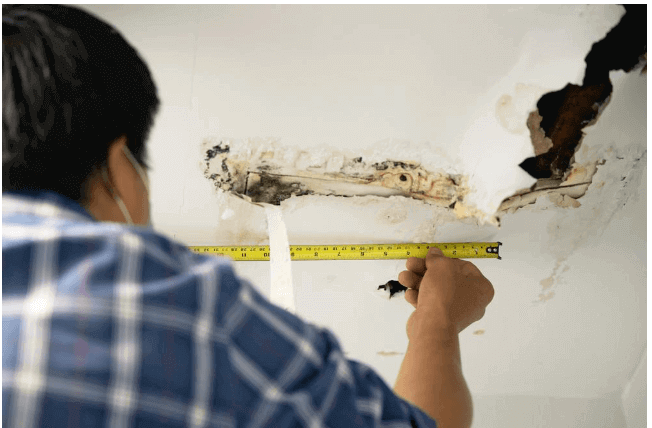

6. Be Aware of Severe Problems

Your inspection report has details about the home’s structural integrity. Severe problems in these areas are red flags, telling you to avoid the purchase.

Analyze information regarding the foundation, plumbing, and electrical systems. Significant cracks in the foundation can lead to expensive repairs. Additionally, outdated plumbing materials might require repiping the entire structure.

Repairing or replacing these core elements may not be in your renovation budget. Ideally, look for another property if you face structural issues in the inspection report.

7. Prepare a Rough Timeline

You may need to be flexible with your timeline after buying a fixer-upper. You may not have a concrete move-in day for a while. Ideally, complete all repairs before moving into the space. It’s much easier to handle the renovations without any residents at home.

Keep your current home or rental as is for now. You can plan for a move-in day as you get close to completing the renovations. Paying down the new mortgage with your current home simultaneously can be a financial challenge, but it can be done with some planning.

8. Communicate With Your Lender

Getting pre-approved for a loan to buy the fixer-upper is an intelligent way to get ahead of the processing time. Once you decide on buying the property, the financing can go through rapidly.

However, it’s important to communicate with your lender about the fixer-upper’s status. The lender may require the inspection report before deciding whether to loan the money. In fact, some lenders may decline the loan because of the risk involved. As long as you stay in communication with the lender and the property’s details, your financing shouldn’t be an issue.

9. Evaluate the Property’s Advantages

Fixer-uppers will also have some advantages for homebuyers. For example, the previous owners may have just installed a new roof. Structural improvements like roofs are solid contributions to a home’s equity. They’re financially attractive to any homebuyer and lender. So, always look at the pros and cons of each fixer-upper before making any decision.

10. Analyze the Overall Investment

Review your renovation budget, purchase goal, and estimated expenses together as you consider a fixer-upper investment. Your ultimate goal is to at least break even with the overall purchase while gaining equity as the home remains in your possession.

If the home requires more money to fix than it’s worth, look for another property. The so-called money pits should be avoided at all costs.

Fixer-Uppers for Every Budget

With a little research and patience, a fixer-upper can be a solid investment. Use a mixture of DIY knowledge and contractor expertise to get the work done. A beautiful home with swelling equity will be the result of your efforts.

Read more: Tips for Selling An Older Home